Guaranty Trust Holding Company PLC also known as GTCO PLC is a leading African Bank that offers retail and investment banking, pension management, asset management, and payments services, headquartered in Victoria Island, Lagos, Nigeria. over the years, the bank has grown into a highly reputable financial institution which has made many people want to get acquitted with the bank. If you are a GTB lover, and you want to open an account or register for Internet banking, you don’t need to look further. All that you need to get started will be explained in steps in this article.

So follow me, and I will hold your hands through the process.

How To Register For GT Bank Internet Banking.

Recently, many people use internet banking. It is an easy and quick way to pay for purchases, check your account balance, and use other online services your bank may provide. If you already use Guaranty Trust Bank’s services or you want to do so you must understand how to register for their online banking account in order to enjoy the convenient, 24/7 service. Moreover, you can also open an account with GT Bank online. Internet banking is a necessary step if you want to make online transactions with no delay.

To register for GT Bank Internet banking kindly follow the steps below.

- Step 1: Visit the GT Bank Web page

- Step 2: Look out for ‘Online banking’ in the top right corner of the home page.

- Step 3: Click register to begin the registration process. You will be shown a short video that explains how to register for GT Bank Internet banking.

- Step 4: Input your GT Bank Nigeria (NUBAN) account number.

- Step 5: Go ahead to enter the last six digits of your ATM card.

- Step 6: Input the date of expiration of your ATM card.

How To Register And Activate GT Bank Transfer Code.

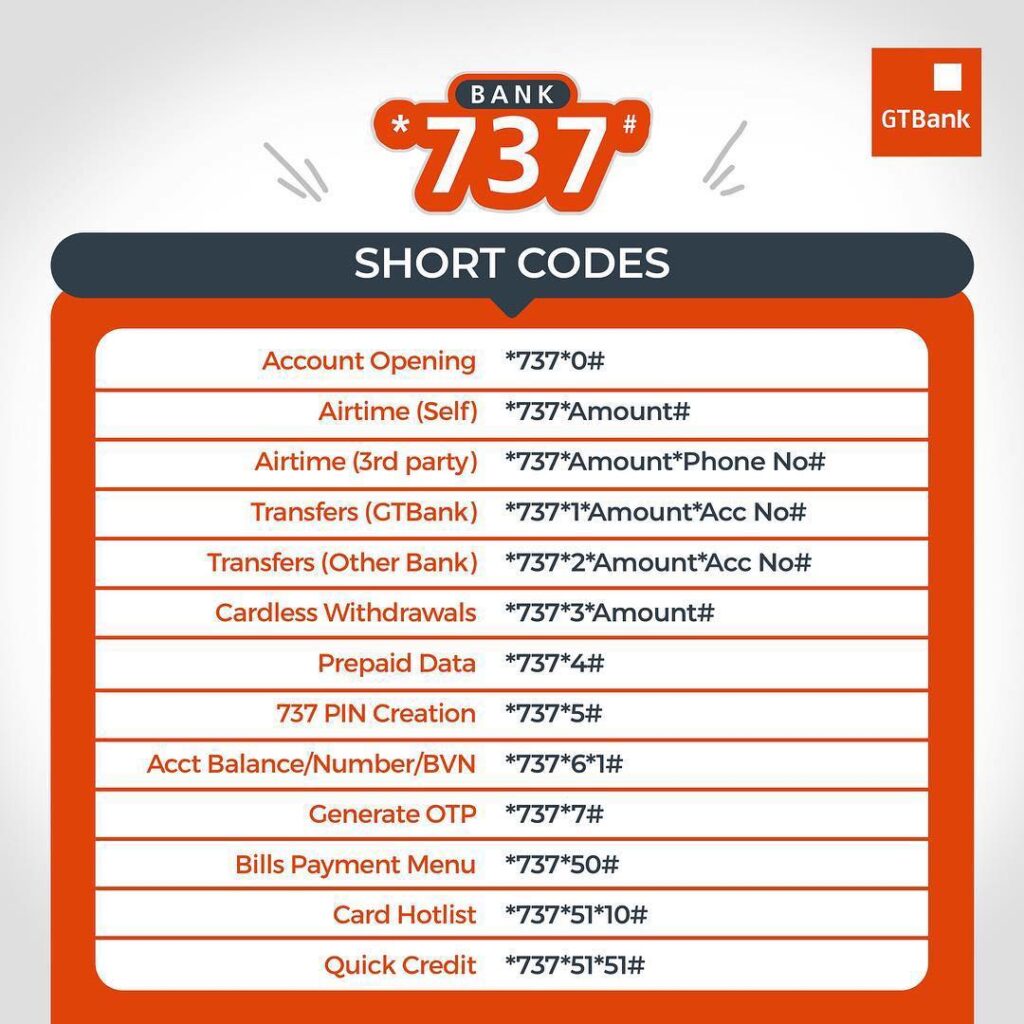

The GT Bank transfer code is *737#. This code allows you to carry out all banking services from anywhere at any time. Using the GT Bank transfer code is easy, safe, and convenient.

Before now, you would have to visit the bank to carry out financial transactions. However, with the transfer code, you do not need to visit the bank to carry out all the financial transactions you need. You do not need an internet connection to carry out any transaction with the GT Bank transfer code. With the GT Bank transfer code, you can carry out financial transactions at any time including weekends and public holidays.

To enjoy simple and easy banking from GT bank, you will need to activate the USSD banking code on your mobile phone. To register and activate the GT Bank transfer code on your mobile phone, follow the steps below

- Step 1: Dial the transfer code *737# with the mobile number you used in registering your account (Mobile number linked to your GT Bank account)

- Step 2: Go ahead to input your 10-digit account number.

- Step 3: Enter your 11-digit Bank verification number (BVN) to proceed)

- Step 4: Input the last 6-digits of your GT Bank ATM card

- Step 5: You will be requested to create a 4-digit PIN to validate your transactions via USSD banking.

- Step 6: Input your preferred 4-digit PIN to proceed

- Step 7: Confirm your entry.

With this, you have successfully activated the GT Bank transfer code.

How To Send Money With GT Bank Transfer Code

GT Bank transfer code allows you to send money from your GT Bank account to another GT Bank account and also to other banks. Follow the steps below to send money via the mobile transfer code.

- Step 1: Dail *737# on your mobile phone (with the registered phone number)

- Step 2: Choose the option that says “Transfer”

- Step 4: Enter the amount

- Step 5: Enter the Beneficiary’s account number

- Step 6: Select the beneficiary’s bank.

- Step 7: Confirm details and Enter PIN.

The funds will be sent to the recipient immediately.

Alternatively,

If you want to send money to another GT Bank account, dial *737*1*AMOUNT*ACCOUNT NUMBER#. Check if the account name corresponds with what you have. If it does, confirm with your 4-digit PIN.

For instance, if you want to send #20000 to account number 0111066660, you will dial *737*1*20000*0111066660#. Follow the on-screen command to complete your transaction. (Check if the Account name corresponds with what you have. If it does, confirm with your 4-digit PIN.)

If you want to send money to other banks in Nigeria, dial *737*2*AMOUNT*ACCOUNT NUMBER#. Check if the account name corresponds with what you have. If it does, confirm with your 4-digit PIN.

How To Check Your Account Balance With GT Bank Transfer Code

If you want to check your current account balance, enter the GT Bank transfer code. Follow the steps below to check your account balance:

- Step 1: Dial the GT Bank transfer code on your mobile phone (Ensure you are doing this with the mobile number linked to your GT Bank account)

- Step 2: Enter your 4-digit PIN to authorize the action

- Step 3: Your account balance will be displayed on the screen

You will also receive an SMS containing your GT bank account balance.

Alternatively, *737*6*1# using the phone number linked to your bank account. Enter your GTB transfer PIN, and your GTBank account balance will be displayed on your screen.

How To Check your GT Bank Account Balance Via GT Bank Internet Banking.

If you want to check your account balance via GT Bank internet banking, follow the steps below:

- Step 1: Visit the GT Bank internet banking webpage

- Step 2: Input your GT Bank account number

- Step 3: Enter your PIN or password.

- Step 4: Click on Login to sign in to your internet banking profile

- Step 5: Navigate to accounts and click on the account number you want to check its balance.

Your account balance will be displayed afterward.

How To Buy Airtime With GT Bank USSD Code

With the GT Bank USSD code, you can purchase airtime for yourself, your family, and your friends anywhere and anytime.

For Airtime and Top-up

- Simply dial *737*Amount# for the registered number ( if you want to purchase airtime for yourself) and *737*Amount*Phone number# for other numbers.

For example, if you want to transfer #1000 airtime to your phone from GT Bank dial *737*1000#.

- And if you want to transfer #500airtime to another phone number (0701346786908) Dial *737*1000* 0701346786908#.

How To Check Your BVN

BVN (Bank Verification Number) is a security number used by banks and other financial institutions to identify individuals with their bank account information. It is a unique 11-digit number assigned to you upon biometric registration.

To check your BVN, dial *565*0# on the number you used in registering your BVN. This code is applicable for Airtel, MTN, GLO, and 9mobile users.

How To Open An Account With GT Bank Of Nigeria.

GT Bank is one of Nigeria’s largest financial institutions and one of Africa’s best banks. You no longer need to leave your home to open a bank account thanks to new advances and technologies. GT Bank has a special online platform for opening an account using your gadget which is called Account Opening Web Engine (GT Bank Online Account Opening).

Here is a quick guide for opening your online account with GT Bank. You can do this directly on your smartphone or on a computer:

- Step 1: Visit GT Bank’s official web page. It is advisable you read everything about different accounts so you can make your best choice.

- Step 2: Vista the account opening webpage

- Step 3: You will need to choose between two options. Either a personal account or a business account. Select your choice and move to the next step.

- Step 4: On the next page you will be asked to either open a new account or an additional account.

- Step 5: Select the account you want to open with GT Bank and the site will automatically update the application form

- Step 6: Input your Bank Verification Number and then click validate.

- Step 7: You will be requested to provide more of your personal details such as your full name, mobile number, and email address. Go ahead to click on the continue button.

- Step 8: With this, you will successfully open your own account online.

However, there are different types of accounts you can create with the GT Bank

Requirements For Creating An Account With GT Bank Nigeria

- Individual domiciliary account

- Passport photographs of authorized signatories.

- Means of Identification (Driver’s License, International passport, National I.D Card, and any other acceptable identification document).

- Two (2) duly completed and suitable reference forms.

- Utility bill issued in the last three months.

2. SKS savings account

- One passport photographs each of the parents and the kid.

- Child’s birth certificate.

- Parent’s valid means of identification (Driver’s license, International passport, National I.D Card, and any other acceptable ID as the Bank deems fit).

- Utility bill issued within the last three months.

3. GTSave account

- Passport photograph of authorized signatories.

- Means of Identification (Driver’s License, International passport, National I.D Card, and any other acceptable identification document).

- Utility bill issued in the last three months.

- Current resident permit for non-nationals

GT Bank Customer Care Service

GT Bank values its customers and recognizes that all customers require respect. They offer a straightforward and seamless banking experience and respond quickly to customer requests.

In case of complaints, you can reach out to their customer care service via phone call, email, or social media platforms.

- To reach GT Bank customer care via email

- To reach via call, call 0700 4826 66328

- To can reach GT Bank customer care on Facebook @Guaranty Trust, on Instagram @gtbank, and on Twitter @gtank and @gtbank_help.

How To Block Your GT Bank ATM Card

Have you ever been in a situation where you cannot find your GT Bank ATM card? It could be stolen, lost, or even misplaced. You can use the GT Bank USSD code to block your GT Bank ATM card. Disable your GT Bank account by dialing *737*51*10#

How To Check Your GT Bank Account Number On Your Mobile Phone

Have you forgotten your GT Bank account number due to one reason or the other? Do not panic!

To check your account number on your phone using the phone number linked to your account which must have been registered for the GT Bank mobile banking simply dial *737*6*1#, and your account number will be displayed on your screen instantly.

Following that, you’ll receive a notification message from GT Bank with your account information.

One of the most crucial actions you can take to attain your financial goals is opening a bank account. Saving your money in an account that is FDIC-insured can give you financial security, simple and easy access to your money, and some level of financial peace of mind. GTBank, Zenith bank, Union Bank, First Bank, Fidelity Bank, Polaris Bank, Eco Bank, Stanbic IBTC, FCMB, Jaiz Bank, Keystone Bank, Sterling Bank, Wema Bank, UBA, Access Bank, and Heritage Bank are some of the other banks in Nigeria that you can choose to partner with.

12 thoughts on “<strong>GT BANK – Internet Banking, Customer Care, How To Transfer Money, Open Account, Block ATM Card, Buy Airtime, Check BVN, Activate USSD Code, Check Account Balance and Account Number</strong>”

Pingback: HOW TO TRANSFER MONEY WITH UBA TRANFER CODE

Pingback: HOW TO SEND MONEY WITH WEMA BANK TRANSFER CODE

Pingback: HOW TO SEND MONEY USING POLARIS TRANSFER CODE

Pingback: HOW TO ACTIVATE HERITAGE BANK TRANSFER CODE

Pingback: HOW TO ACTIVATE STANBIC IBTC TRANSFER CODE

Pingback: HOW TO ACTIVATE ZENITH BANK TRANSFER CODE

Pingback: HOW TO SEND MONEY WITH FIRST BANK TRANSFER CODE

Pingback: UNION BANK - Internet Banking, Customer Care, How To Transfer Money, Open Account, Block ATM Card, Buy Airtime, Check BVN, Activate USSD Code, Check Account Balance and Account Number - Learners Dorm

Pingback: ECO BANK - Internet Banking, Customer Care, How To Transfer Money, Open Account, Block ATM Card, Buy Airtime, Check BVN, Activate USSD Code, Check Account Balance and Account Number - Learners Dorm

Pingback: HOW TO SEND MONEY WITH STERLING BANK USSD CODE

Pingback: How To Activate Stanbic IBTC Transfer Code - Learners' Dorm

Pingback: Bank, Non-Bank and Traditional Financial Institutions In Nigeria - Types, Roles, Challenges, Regulatory Agencies, and History - Learners Dorm